What kind of payments are accepted on Pushpay’s echurch giving platform?

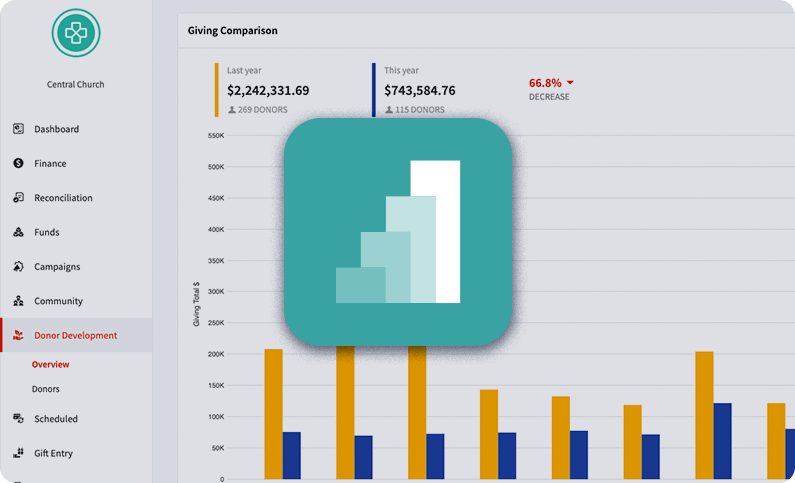

Pushpay’s church online giving software allows donors to make church contributions easily through your church website, text message, through your mobile church app, or kiosk. Congregants can make payments through credit card, debit card, or ACH, either right now or scheduled for later.